Master Tally ERP & GST

Start Your Career in Tally ERP

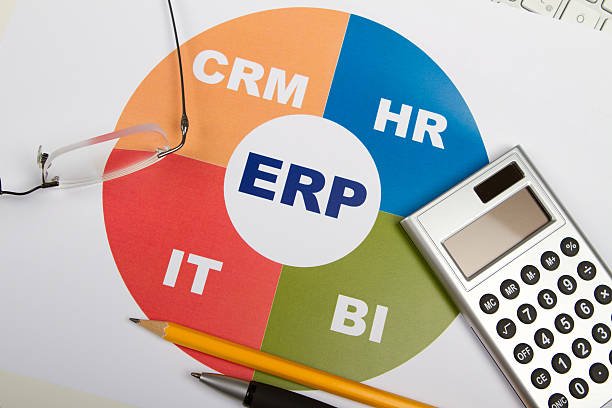

Tally ERP (Enterprise Resource Planning) integrates various business functions such as accounting, inventory management, taxation, payroll, and compliance into a single system. It is known for its simplicity, speed, and reliability.

Why Choose Tally ERP

Learn with practical accounting training.

Get job-ready with interview preparation and expert guidance.

Key Features of Tally ERP Training

1. Easy to learn with real-time practical accounting example.

2.Covers Tally ERP with GST, Taxation & Compliance.

3.Strong foundation in accounting principles & business finance. 4.Hands-on practice with live billing and ledger creation. 5.Introduction to GST returns, TDS & payroll.

6.Works with modern accounting tools.

7.Essential for accountant, billing executive & finance roles.

8.Supports freelancing, SMEs, startups & corporate car

📊 Tally ERP

It is an accounting and business management software used to manage financial transactions, inventory, payroll, banking, and taxation in a simple and efficient way.It helps businesses maintain accurate records, generate reports, and make better financial decisions.

🧾 GST (Goods and Services Tax)

1.GST (Goods and Services Tax) is an indirect tax applied to the supply of goods and services in India.

2.It replaced multiple taxes like VAT, Service Tax, and Excise Duty to create a unified tax system.

Tally ERP & GST is a comprehensive accounting course that teaches practical bookkeeping, taxation, and financial management using industry-standard tools. The training covers GST complian billing, payroll, and real-time accounting practices to prepare learners for accountant and finance roles.

Tally ERP & GST with Practical Training and Interview

Master Tally ERP & GST with hands-on practical training through real-time accounting work. Get interview-ready with expert guidance, mock interviews, and job-focused preparation.

Other Courses